Buy These 5 Short Squeeze Stock Ideas

Thomas Barwick/DigitalVision via Getty Images

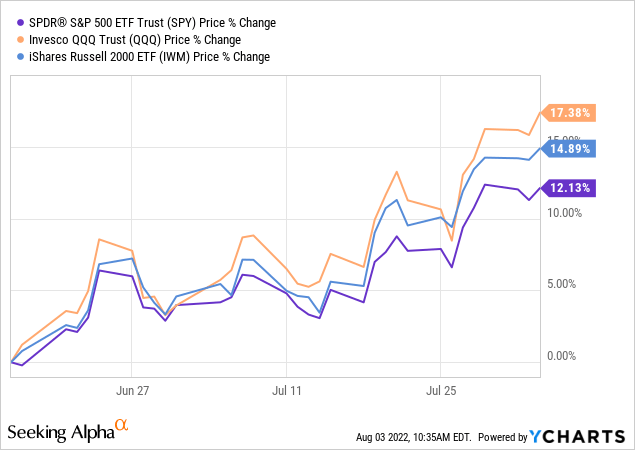

All the talk in the market right now is a scramble to explain away the monster rally in recent weeks. The S&P 500 (SPY) is up over 13% from its cycle low while the NASDAQ-100 (QQQ) has fought back nearly 20%. For a lot of investors, it’s hard to understand how or why stocks are gaining momentum in an environment of record inflation, Fed tightening, and otherwise poor indicators. The bears even got some fodder with a confirmation of a recession with Q2 GDP data posting a second consecutive quarter of contraction. While this is all true, our message here is to recognize that the stock market does its own thing by ignoring emotions and focusing more on the forward outlook.

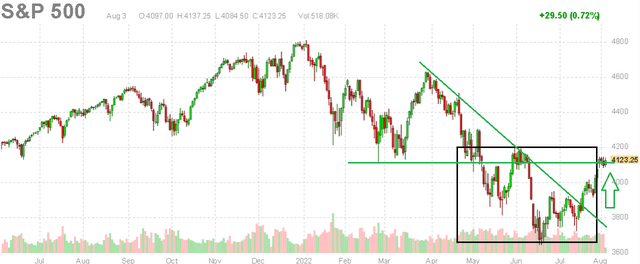

We’re looking for a big pivot over the next few weeks, but it’s probably not the pivot you’re thinking of. We expect a wave of stock market bears and doom-and-gloomers to flip long. The reality here is that the S&P 500 is approaching a 3-month high and anyone calling for a leg lower over this time frame has been wrong thus far.

The setup is simply a new short squeeze that will add further momentum to the upside based on a fear of missing out. If the bottom in stocks is in, there is more upside here and it will be painful for anyone going against the trend.

source: finviz.com

The Big Pivot

Mark your calendars but August 10th will be a massive day to shift the market regime as the July CPI data gets released. We don’t have a crystal ball, but it also doesn’t take an Economics PhD or Chartered Financial Analyst to see room for a cool inflation data print next week as being very bullish for stocks. The news flash is that gas prices are down $0.83 per gallon as a national average since their peak in mid-June. According to data from AAA, the trend is heading under $4.00 per gallon nationally. Consumers saving $10-$20 dollars filling up each gas tank translates into more discretionary income for everything else.

This is a major development that should be reflected in the July CPI that both directly holds the monthly inflation rate down while supporting an economic rebound. There are also signs that retailers are moving towards aggressive discounting. Everyone from Walmart Inc (WMT) to Target Corp (TGT) has cited the need to cut prices to move inventory.

In our view, there is a major component of the 9.1% inflation rate in June that really was transitory. As supply chain conditions normalize, facilitated by lower energy prices, a CPI of 4% or lower by next year is realistic. Again, we’re not suggesting “prices” are ever going back to 2019 levels, but simply that the rate of change will slow.

Putting two and two together, we’re not seeing an environment of runaway inflation or a collapse of economic activity. On that point, Q2 earnings season has been solid. Mega cap names between Apple Inc (AAPL), Amazon.com Inc (AMZN), and Alphabet Inc (GOOGL) are proving capable of navigating the current environment which has positioned them to lead the market higher.

For us, inflation is all that matters. A narrative that the trend of higher consumer prices has peaked has implications for supporting “leading indicators” like consumer sentiment, and the Purchasing Managers Index which have been near historical lows. Fast forward 3-4 months, the environment will be of a building recovery with better-than-expected data. Corporate margins can also capture some breathing room. Again, all this will be positive for stocks.

For the Fed’s part, there’s no pivot required. The Board has said they are data dependent and you can lock in a couple more 25-50bps hikes with a CPI trending lower as a confirmation their strategy is working. This doesn’t need to crash the economy. At some point, holding the Fed Funds rate flat, maybe by early 2023, backed by moderate economic growth can be a positive for further stock market gains driven by earnings. As long as the labor market remains relatively stable, calls for a return of depression-style breadlines won’t happen.

5 Short Squeeze Ideas

We mentioned some market leaders have done great already into Q2 earnings season with big gains. Simply buying SPY can make sense as a core holding within a long-term portfolio. That said, we believe the real action is in beaten-down names that have yet to really break out.

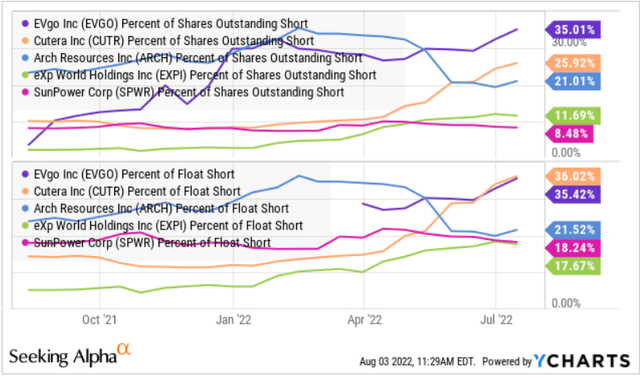

One bucket for ideas is among heavily shorted stocks. These are companies that for the most part have underperformed with extreme bearish sentiment betting for more downside. If we’re correct and the macro environment improves, expect heavily shorted names to generate significant upside going forward.

Today we are highlighting five stocks we like that just so happen to have high short interest. Compared to the “meme stock” phenomenon of 2021 where heavily shorted stocks were rallying simply for the sake of having a high short interest, our views here are based more on fundamentals. We expect these companies to stage a real operating and financial turnaround.

source: YCharts

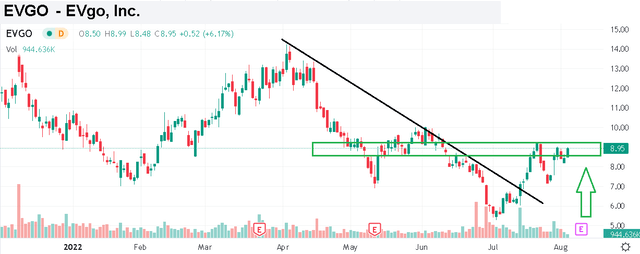

EVgo Inc (EVGO)

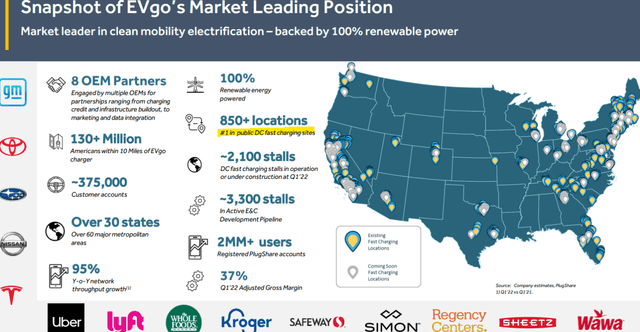

EVgo operates electric vehicle charging stations, owning one of the most extensive networks of public access “fast chargers”. The attraction here is the recognition that the national infrastructure of chargers will need to expand significantly as EV’s across all automobile brands gain market penetration. From EV’s representing 6% of vehicles sold in the U.S. in 2021, that level is expected to climb towards 30%, representing the opportunity companies like EVgo is targeting.

source: company IR

We recently covered the stock, highlighting how an ongoing expansion of capacity over the next few years sets EVgo with one of the highest forecast growth rates over the next three years among a peer group of EV charging solutions companies. Revenues are expected to increase from $50 million this year to $275 million by 2024.

With 35% of common shares outstanding reported short, the bears may be too quick to dismiss the bullish case for the company as it reaches scale with firming financials. EVgo is set to report Q2 earnings on August 9th which could be a catalyst for shares to breakout higher on positive guidance from management.

Seeking Alpha

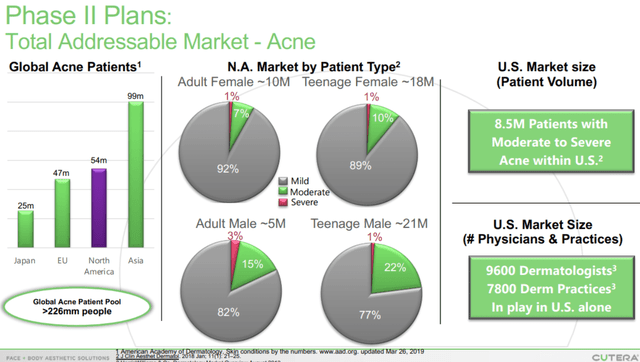

Cutera Inc (CUTR)

The bears are not convinced on Cutera Inc given its reported 26% short interest. The company specializes in medical devices focusing on aesthetics as non-surgical solutions for skin revitalization and body sculpting. A major development this year was the FDA clearance for the company’s “AviClear” device as the first and only energy-based acne treatment representing a safe and more effective alternative to powerful medications typically used for severe cases. We believe the product will take off as it launches commercially by the end of the year.

source: company IR

Notably, shares traded as high as $75 on the initial announcement only to give up all the gains amid the broader market volatility in recent months. The bullish case here is that any update from management regarding early orders or financial targets related to this key product will work as a catalyst for the stock.

Seeking Alpha

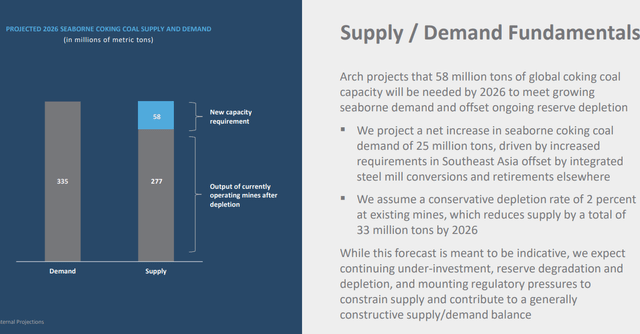

Arch Resources Inc (ARCH)

Coal has evolved into a four-letter word over the last several years given its poor environmental record and the global push towards renewables. Still, the energy crisis of this year has helped to recast a spotlight on the importance of this fossil fuel within the global system and for steel production. Tight supply conditions globally, further pressured by natural gas deficits in Europe amid the ongoing Russia-Ukraine conflict, should keep coal in high demand.

source: company IR

We like Arch Resources as a U.S.-based producer and exporter which has done everything right to continue sustainably meeting the real market need while benefiting from record prices this year. Shares have pulled back nearly 30% from a recent high while we believe the current level offers a compelling entry point near support.

The company remains highly profitable with significant cash flow that will make it hard for the bears to keep dragging it lower. The stock has a reported short interest of 21% making it susceptible to a squeeze into another leg higher in coal and steel prices.

Seeking Alpha

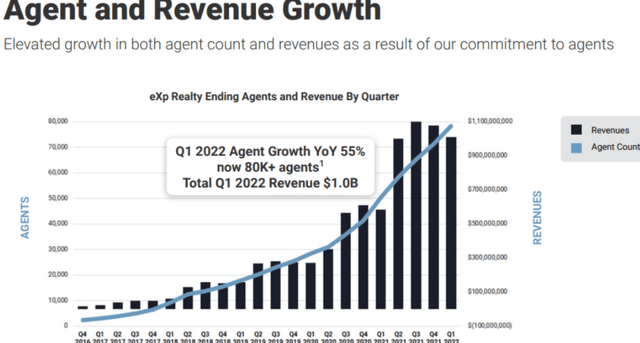

eXp World Holdings, Inc. (EXPI)

EXPI is recognized as an “online-only” real estate brokerage firm. An attractive agent commission split model and lower overhead compared to traditional brick and mortar operations have driven impressive growth over the last several years.

source: company IR

Clearly, momentum has slowed alongside the housing market explosion in 2021 which is reflected in sh

ares down more than 70% from its high. That being said, the strong point here is the overall solid fundamentals with the long-term growth story intact. Even as the housing market slows, the bullish case here is that EXPI continues to capture market share as it expands globally.

While Q2 earnings missed expectations, revenue beat and we see compelling value in shares trading at just a 15x earnings multiple on the 2023 consensus EPS. The company is profitable and even offers a quarterly dividend that yields 0.8% along with continued buybacks. The upside here is that as macro conditions improve, shares are ready to sustain a rebound higher.

Seeking Alpha

SunPower Corp (SPWR)

SunPower is a U.S.-based provider of solar solutions focusing on residential rooftop applications. This is an exciting segment considering the recent developments from the new clean energy/climate bill gaining traction in the U.S. Congress. Upwards of $369 billion are being slated across tax credits and direct investments towards renewable energy technology like solar. Assuming the bill goes forward, SunPower is a winner as specific provisions in the bill offer subsidies to accelerate the adoption of rooftop solar.

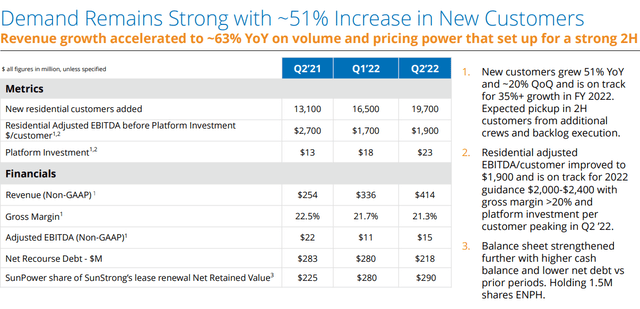

source: company IR

The company just reported its Q2 earnings highlighted by a 60% increase in revenue as the company ramps up its production with strong customer bookings. The backdrop here suggests the company can gain momentum forcing the shorts to pare back any bets the business model will not succeed. We last covered the stock back in March and reaffirm a call for shares to rally towards $27.50 as our first price target.

Seeking Alpha

Final Thoughts

It’s a great time to be a stock picker but the first step is to get the direction right. We’re bullish and expect more upside. Watch for the market narrative to evolve over the next few weeks into an environment where improving conditions support more upside in stocks as the rally accelerates.

Covering some risks, we can bring up the ongoing Russia-Ukraine crisis. An escalation of the conflict into Europe would clearly undermine any optimistic scenario. Similarly, we want to watch energy prices with the risk for a sharp rebound in oil and gas driving a resurgence of inflationary pressures. Overall, it’s important to keep an open mind to both sides of the discussion. The bears had an upper hand to start the year but the bulls may end up on top.