Down 40%, Yet I’m Doubling Down On My Top Stock Ideas For 2022

nzphotonz/iStock via Getty Images

Introduction

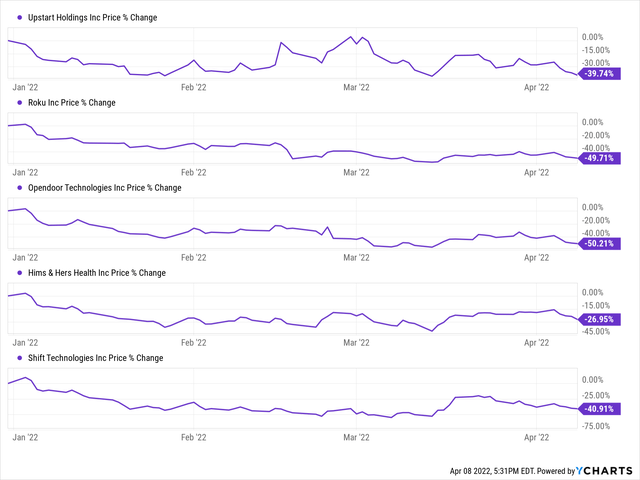

In late December 2021, I published ‘My Top 5 Stock Ideas For 2022’ with a detailed discussion of the macroeconomic setup going into 2022 and the logical argument for investing in (relatively) small, rapidly-growing companies in the face of multi-decade high inflation. While my investment horizon is long-term (5+ years), and I am not flustered about short-term fluctuations in my portfolios, I think it is fair to check up on investments after a very rough quarter to see if the investment theses are still intact.

Top ideas For 2022: Year To Date Performance (Avg. Q1’22 loss: -41.5%)

YCharts

In this note, we will review the business performance of each of my top ideas for 2022 and check up on their valuations. Later, we will analyze some extrinsic macroeconomic factors that seem to be driving the sentiment and price action in the high-growth tech stock universe.

Summary of Q4 results & Outlook For The Rest Of 2022

The goal of this exercise is to verify the validity of our previously laid out investment theses. In this section, we shall take a look at Q4 2021 reports to assess the strength of the underlying fundamentals of these aforementioned businesses. For the purpose of brevity, I will only share key highlights and updated outlooks (for 2022) in this note. So, without further ado, let’s get started.

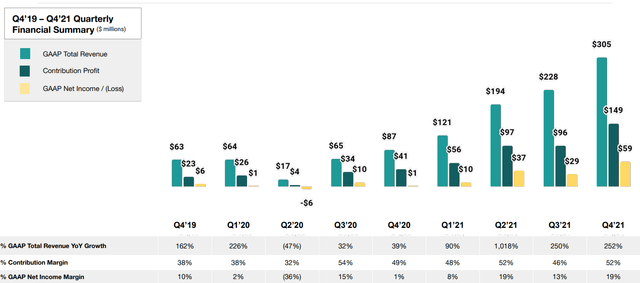

1. Upstart Holdings (UPST):

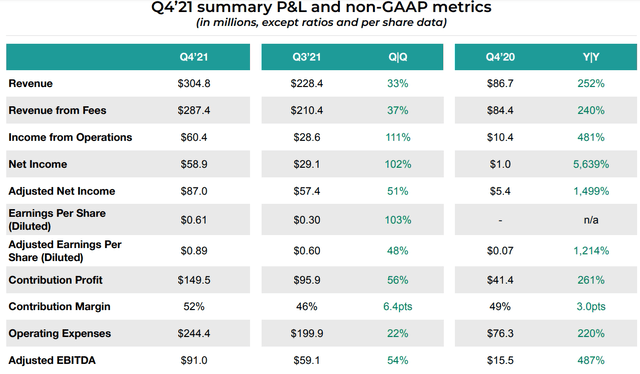

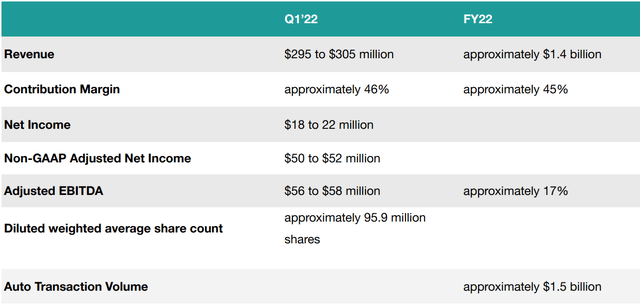

In Q4 2021, Upstart obliterated management guidance and consensus analyst expectations by reporting ~$304M in revenue for the quarter, i.e., a sequential jump of 33% in sales. With contribution margins of ~52%, Upstart’s hypergrowth also happens to be very profitable.

Upstart Earnings Presentation

Upstart Earnings Presentation

On top of its staggering growth in 2021, Upstart has guided for growth of 65% in 2022. We believe that Upstart’s sales will grow closer to 80%, reaching about $1.6B to $2.0B in 2022.

Upstart Earnings Presentation

As you may know, Upstart is entering the auto loan market (~6x greater TAM than personal loans) with its Upstart Auto Retail platform, and early dealer rooftop numbers are certainly very promising. In my opinion, Upstart has a virtually infinite TAM with potential for expansion into other loan categories like mortgage, small business loans, etc.

While rising interest rates are seen as a concern for Upstart by many critics, the company holds no interest rate risk on its balance sheet (asset-light model). The fears over the health of ABS [asset-backed securities] markets and rising delinquencies are overblown too. Upstart has multiple channels to sell its loans; the ABS market is just one of them. As long as Upstart’s credit underwriting performs better than traditional underwriting, Wall Street firms will keep eating up its loans, and more and more banks will be happy to originate these loans. I firmly believe Upstart’s AI-based credit underwriting will continue to outperform peers if we enter a recession (as it did back in 2020 during the early days of the pandemic).

From a fundamental perspective, Upstart is absolutely killing it right now. And future outlook suggests Upstart is set to continue this trend for years to come. While Upstart is now trading at $91 per share, roughly 40% lower from where I suggested it as a top idea, the business is still firing on all cylinders. Furthermore, Upstart has announced a $400M stock buyback program (the company would likely make this much in FCF over the next 12 months), and at its currently depressed valuation of $8.7B, the company could eliminate ~4.5% of its total shares outstanding in 2022 (boosting its FCF per share).

As of today, I see no change to my original investment thesis shared in the top ideas note linked at the top of this article. If you are interested in a more detailed analysis of Upstart’s Q4 2021 earnings report, please head over to this exclusive marketplace research note from Louis Stevens (Founder of BTM): The State Of Our Stocks 41 (Part I)

2. Roku (ROKU):

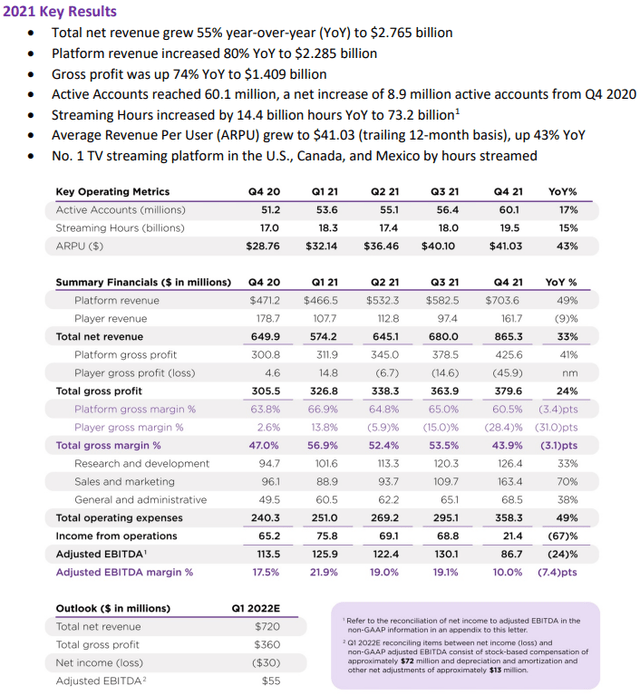

In Q4 2021, Roku’s revenue came in at a record $865M (up +33% y/y), which was ~4% short of management’s guidance [second miss in a row]. The primary driver of weakness in Roku’s business is stemming from supply chain issues – 1. higher input costs crushing player margins, 2. low inventory hurting TV and player sales, and 3. weakness in auto and consumer packaged goods advertising verticals (no inventory to sell (advertise)).

Despite facing these headwinds, Roku managed to add 3.7M new active user accounts and increase platform ARPU to $41 (up 43% y/y). In other highlights, Roku is now the No.1 TV OS platform by hours streamed in Canada and Mexico (initiated ad monetization as Roku crossed 20% market share in the region).

Roku Q4 2021 Shareholder Letter

Now, Roku’s management continues to expect these headwinds to hur

t business in the near term (at least in the first half of 2022); however, as these supply chain issues ease over time, and we are not lapping over periods of exceptionally high growth rates, Roku’s revenue growth is set to re-accelerate over coming quarters.

Considering Roku’s growth potential and depressed stock, I don’t think there is a better (safer) digital ad play out there right now. Despite temporary headwinds, Roku’s Ad business is going from strength to strength, and the current weakness in its stock is a must-buy opportunity. The in-depth review of Roku’s quarter and outlook for 2022 is available here: Roku Stock: Glorious Opportunity For Savvy Long-Term Investors

3. Opendoor (OPEN):

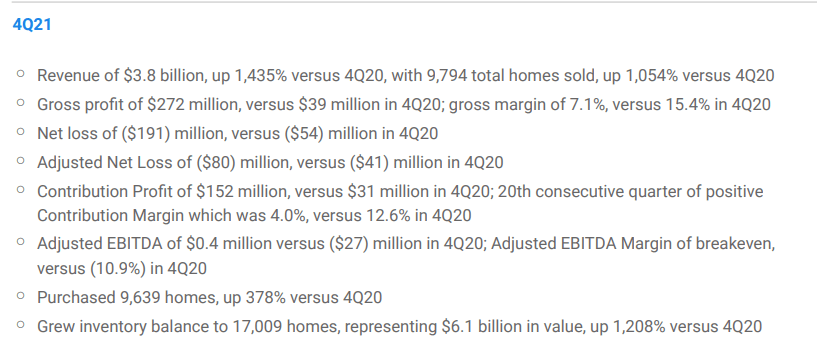

In Q4 2021, Opendoor’s revenue hit new highs of $3.8B (up 1435% y/y, beat expectations by ~20%) on home sales of 9.7K (up 1054% y/y). Both of these numbers were well above management’s guidance and consensus analyst estimates and clearly indicated the resounding success of Opendoor’s solutions for buyers. Furthermore, Opendoor acquired ~9.6K homes last quarter, keeping its inventory at ~17K homes. With a cash balance of ~$2.2B, Opendoor’s liquidity status is healthy.

Opendoor Q4 2021 Shareholder Letter

Opendoor Q4 2021 Shareholder Letter

As you may know, we are currently in a period of macroeconomic uncertainty, with the US Federal Reserve looking to tighten policy amid raging hot inflation (caused by supply chain issues), which is being further complicated by Russia’s invasion of Ukraine (increased geopolitical risk). However, Opendoor’s business is not facing any existential crises (as indicated by its stock price) – housing supply in the US is still near all-time lows, and mortgage rates have moved above 4% (pre-pandemic levels) without any signs of demand deterioration (robust demand in the housing market), which means house prices are unlikely to go down by much in 2022. If high inflation persists, Opendoor’s $6B housing inventory will appreciate, and we could probably see a profitable year if the HPA (home price appreciation) in the United States is as strong as last year (unlikely, but possible).

Opendoor’s unit economics, as represented by contribution profit margin (~4% in Q4 2021), have remained positive for the last 20 quarters. Despite some weakness here in this past quarter, Opendoor’s CPM is expected to rise in the next quarter and over coming years. Over the last twelve months, Opendoor’s value proposition has resonated with customers (both home-sellers and home-buyers), and this is clearly indicated via the big numbers posted by the company (we are exiting 2021 with an ARR of ~$15B). In 2021, Opendoor launched key products such as Opendoor-backed Offers [OBO] and Opendoor Complete. Further, the company expanded its footprint from 21 markets to 44 markets while simultaneously expanding its buybox coverage by 50%, enabling the company to bid on 60%+ transactions in its serviceable markets. A Seller NPS of 80 and a Buyer NPS of 60 are indicative of high customer satisfaction for Opendoor’s solutions and re-engage rate of >30% is simply outstanding. Opendoor is revolutionizing the way houses are bought and sold by delivering a ~10x better customer experience at lower costs than the traditional way.

The market hates iBuyers, and the consensus belief is that this business model will never work. However, Opendoor’s business performance and methodical platform expansion tell a different story altogether. Opendoor is doing what no other company has ever managed to do, and only a few may be able to replicate, if at all. Our conviction in Opendoor’s vision and its management’s execution capabilities has never been greater, and hence, we view the sell-off in Opendoor as a generational buying opportunity. Like many of you, I am already overweight on Opendoor, but there’s no way we don’t buy at this ridiculous price of ~$7.3. Stay convicted, and buy Opendoor without fear.

Source: Opendoor Stock: All Aboard Roller Coaster

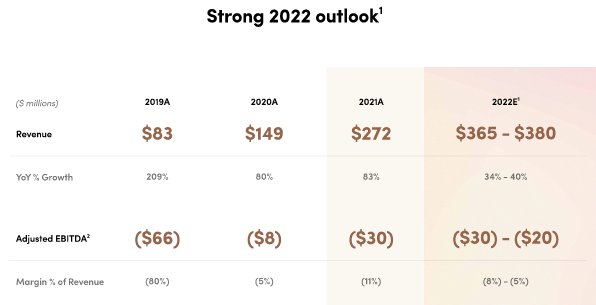

4. Hims & Hers Health (HIMS):

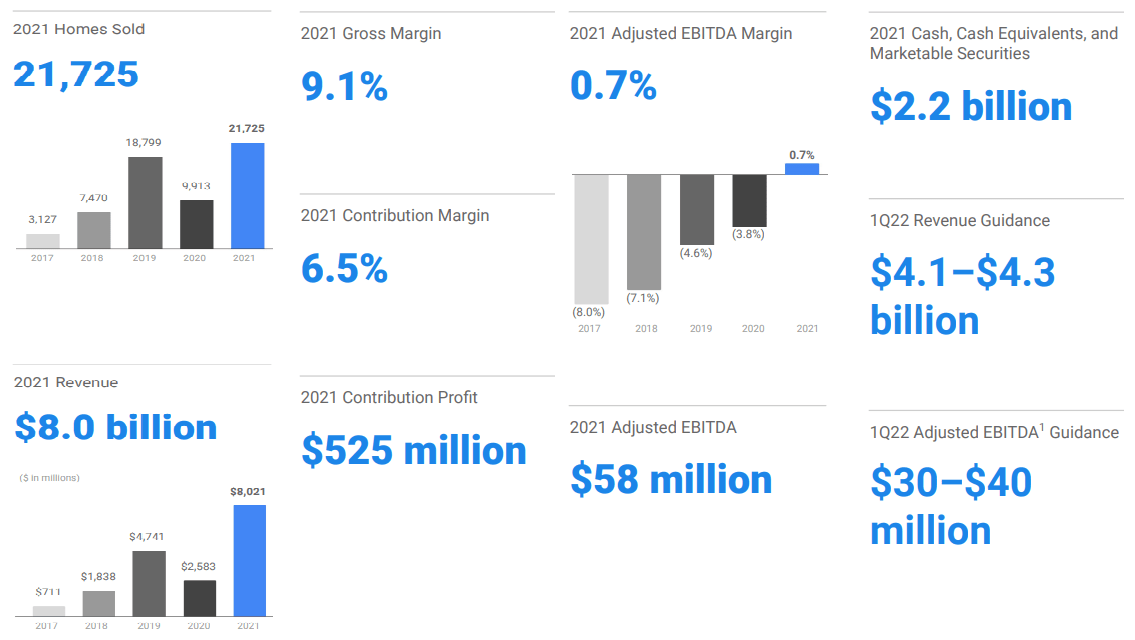

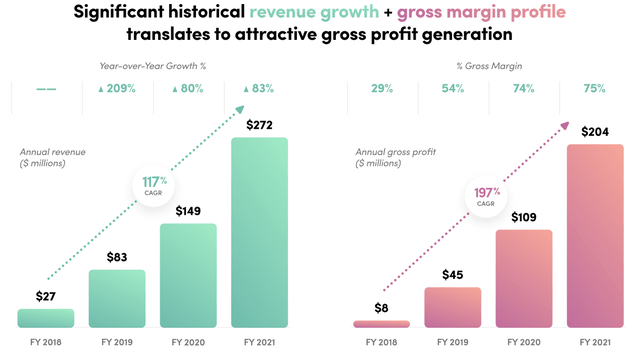

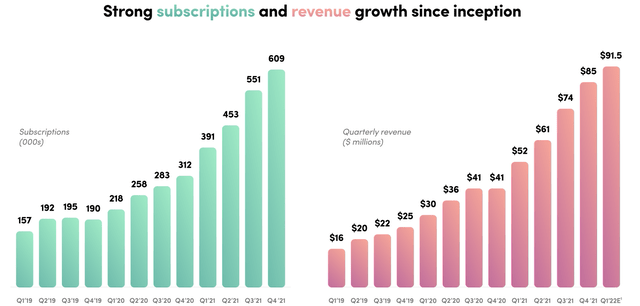

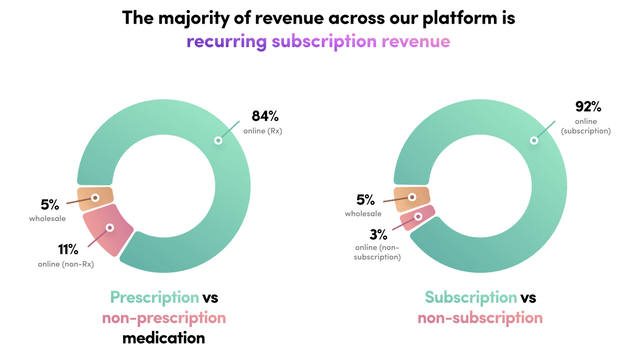

In Q4 2021, Hims & Hers reported y/y sales growth of 104% (quarterly revenue reached ~$85M), which represented yet another re-acceleration. From my top ideas, I think Hims & Hers had the best quarter to close out 2021. While critics continue to lambast Hims & Hers as an online seller of commodity products, the subscription and margin numbers clearly tell a different tale. More than 90% of Hims’ revenue is subscription-based, and the company has (SaaS-like) gross margins of 75%.

Hims & Hers Investor Presentation

Hims & Hers Investor Presentation

Hims & Hers Investor Presentation

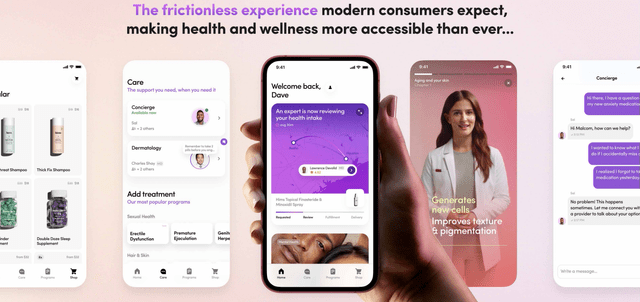

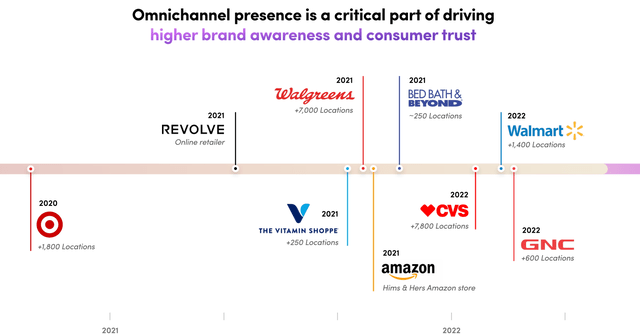

By building an omnichannel presence, Hims & Hers is evolving into a modern front door to healthcare, and this digitally-native telehealth platform is showing the potential to become a household brand in the long-term future. In Q4 2021, Hims & Hers launched its own mobile app (which is very slick) to improve customer experience. In early 2022, the company also announced retail partnerships with CVS and Walmart, two of the largest store chains in the US. In summary, Hims & Hers is making massive progress on all fronts.

Hims & Hers Investor Presentation

Hims & Hers Investor Presentation

There’s not an iota of doubt in my mind that Hims & Hers is an exceptionally well-run company. The business momentum is looking incredible, and while the 2022 sales guidance of 40% indicates a sharp deceleration in growth, I am convinced about Hims’ ability to deliver compounded growth over the next decade. Furthermore, Hims & Hers has a rock-solid balance sheet and minimal cash burn.

Hims & Hers Investor Presentation

To understand our bullishness on Hims & Hers more deeply, please refer to my partner – Jared Simons’ latest research on the company: HIMS Stock: Great Buying Opportunity

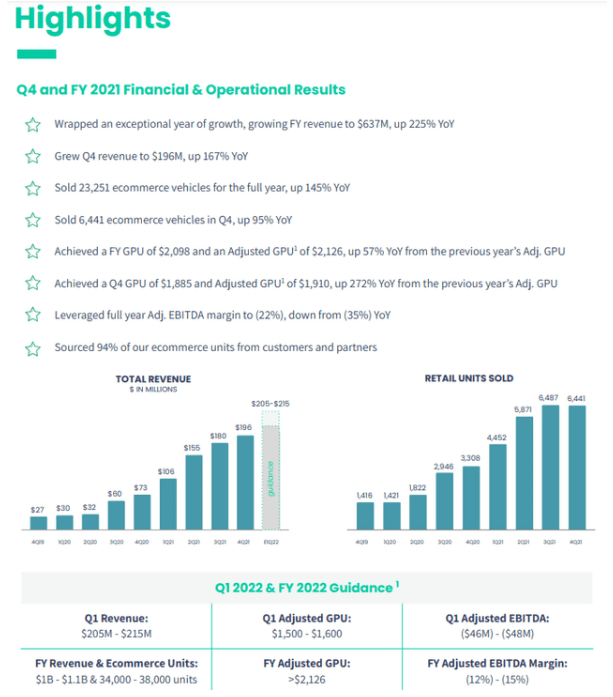

5. Shift Technologies (SFT):

With continued supply chain pressures inducing inflation, the pricing environment in the used-car industry remained robust in Q4 2021. On the back of this strength, Shift generated record revenues of ~$195M (up 167% y/y) in the last quarter, and we are almost through Q1 2022, so the company’s guide of $205-215M is really actual numbers. In my view, Shift is performing well, and its share price action (the company is trading at ~1.25x net cash) is absolutely ridiculous.

Shift Q4 2021 Shareholder Letter

In addition to strong unit sales, Shift’s GPU was robust in Q4 2021 (considering seasonal weakness). For Q1 2022, Shift’s adj. GPU guidance of $1500-1600 may seem weak, but this is just a result of price rise normalization in the used-car industry (and seasonality). The attach rate for ancillary services is improving, and as such, Shift expects to record adj. GPUs of 2200+ in this year. In my opinion, the top-end of revenue and unit guidance of $1.1B and 38,000 units is conservative and sets up the company for a series of “beats and raises” in 2022. Overall, Shift’s Q4 was in-line with our expectations from the company, and I am happy with the reported numbers.

As Shift continues to scale revenue, it is delivering operating leverage as evidenced by narrowing (highly negative) EBITDA margins. For 2021, Shift’s adj. EBITDA margin came in at -22% vs. -37% (figure from 2020). In 2022, Shift’s management expects this margin profile to improve significantly from -22% to a range of -12% to -15%. While Shift is years away from breakeven (and FCF generation), the business is scaling up rapidly and simultaneously improving operational efficiencies. After undergoing some managerial upheaval in the last few quarters, the company seems to have settled on the executive leadership team of George Arison [co-founder, CEO], Oded Shein [CFO], and Jeff Clementz [President] – people with experience of growing e-commerce businesses. Along with Q4 results, Shift’s management released an investor presentation that outlined Shift’s path to EBITDA breakeven.

Source: Author’s note

While pricing dynamics in the used car industry have been moderating over the last three months, the supply chain issues are far from over. Furthermore, Shift’s average holding period is still quite low. Hence, I am not concerned about Shift’s inventory levels. The most important highlight of Shift’s quarter was the announcement of Softbank’s investment (debt + capital) in the company.

While the cash burn situation is complicated (bankruptcy is possible in the next 12-18 months if no capital is raised), Softbank’s investment in Shift during Q4 is a very positive development. Shift’s management is confident about the company’s path to profitability and its ability to attract institutional investors (like Softbank) for future capital raises. My analysis and available evidence tell me that Shift’s management is more than likely to be right. Shift remains a high-risk, high-return bet. Considering the asymmetric risk/reward opportunity and management’s execution history, I am more bullish than ever on Shift.

Source: Shift Q4 Review: I’m More Bullish Than Ever

Now, let’s turn our attention to valuations.

Valuation check

Considering business performance, near-to-medium outlook for growth, and ongoing valuation compression, I believe that all five of my top ideas are in deep value territory. There’s really nothing more to say about current valuations here, as these prices are completely detached from fundamentals.

Here’s a tabular summary:

| 2022 Revenue Guidance or Consensus | Implied y/y Growth Rate | Market Cap | Forward P/S multiple | |

| Upstart (UPST) | $1.4B | 65% | $8.7B | 6.2x |

| Roku (ROKU) | $3.8B | 35% | $17.1B | 4.5x |

| Opendoor (OPEN) | $15B | 87% | $4.75B | 0.3x |

| Hims & Hers (HIMS) | $380M | 40% | $1.05B | 2.59x |

| Shift (SFT) | $1.1B | 72% | $185.9M | 0.17x |

Source: SEC Filings

If these businesses are performing well, and their valuations are the lowest they have ever been, then why did these stocks go down ~40% in just one quarter and were lower by quite a bit in the last week too! What’s driving this crazy price action?

Fundamentals Are Fine, And Valuations Are Dirt Cheap. Then, Why The Crash?

As you may know, asset prices are a function of supply and demand. With multi-decade high inflation, the demand for long-duration assets like high-growth tech stocks is sinking, and unprofitable growth stocks with high trading multiples are facing the worst of this valuation re-rating. In the near term, Mr. Market tends to behave like a drunken psycho, and currently, he is on an ‘anything growth’ selling spree. To make matters worse, global central banks are set to fight inflationary pressures with interest rate hikes and quantitative tightening, which is raising the fears of a recession.

While I am seeing signs of inflationary pressures caused by supply chain issues cooling off, viz. used car prices are down three months in a row, trucking spot rates are down after peaking in early January, and there are many more such examples. However, Russia’s invasion of Ukraine that began in late February has led to a surge in commodity prices, and that means higher inflation is staying with us longer than what most people expected.

Back in late December, I said that –

The Fed has a dual mandate – maximum employment and price stability. While unemployment numbers have gone down significantly after the pandemic-induced economic recession, we are still not at maximum employment. However, raging hot inflation is causing panic among central bankers, and they must now tighten the monetary policy to ensure price stability.

And now, in early April, even the most dovish members of the Fed have turned super-hawkish. Here’s some commentary from one such [former] dove, Fed Governor Lael Brainard (shared on CNBC) –

Today, inflation is very high, particularly for food and gasoline. All Americans are confronting higher prices, but the burden is particularly great for households with more limited resources. That is why getting inflation down is our most important task, while sustaining a recovery that includes everyone. This is vital to sustaining the purchasing power of American families.

It is of paramount importance to get inflation down. Accordingly, the Committee will contin

ue tightening monetary policy methodically through a series of interest rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting.Given that the recovery has been considerably stronger and faster than in the previous cycle, I expect the balance sheet to shrink considerably more rapidly than in previous recovery. Currently, inflation is much too high and is subject to upside risks. The Committee is prepared to take stronger action if indicators of inflation and inflation expectations indicate that such action is warranted.

Source: CNBC

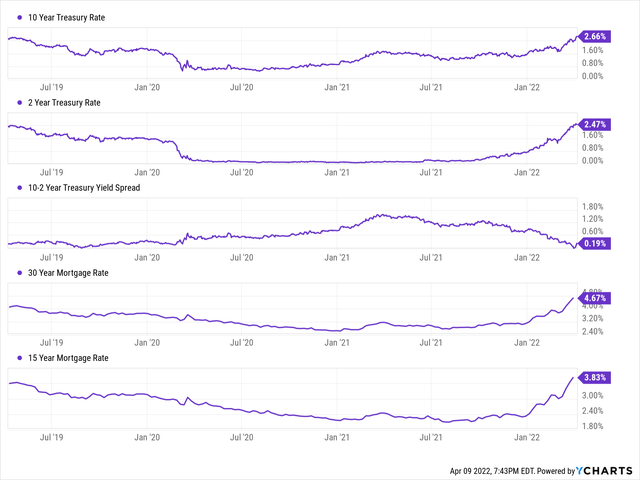

Also, recently released Fed minutes revealed the Federal Reserves’ willingness to begin quantitative tightening at a never-seen-before scale of ~$95B per month ($60B of treasury and $35B of mortgage-backed securities). The bond market is now taking the Fed seriously, with treasury yields rising up sharply in recent weeks.

YCharts

Are bond traders/investors trying to front-run the Fed? I don’t know, but rising interest rates and potential inversion of the yield curve are ominous signs of an impending recession, and this seems to be causing a lot of panic among growth investors.

After flooding the markets with tons of liquidity over the last two years, the Fed has now made a u-turn, and the single most important objective now is to curtail inflation. In order to do so, the Fed plans to remove liquidity from the markets, and in this process, it will likely cool down the raging hot bull markets in stocks, bonds, and real estate. If the Fed moves too fast with rate hikes and quantitative tightening, it could quite easily send the US economy into yet another recession.

With that being said, my thoughts on the upper bound (of 3-4%) on treasury rates remain unchanged, and I laid out my reasoning here:

- Inflation Hits 7%, But The Fed Is Stuck Between A Rock And A Hard Place

In a nutshell, I believe that government debt (as a % of GDP: 130%+) is just too high right now, and increasing interest rates beyond 3-4% would most likely send the US government into an unprecedented debt crisis (and potentially a first-ever default). On the other hand, higher inflation for longer would allow for strong economic expansion, i.e., the US government could deflate its $30T debt load via inflation. As crazy as this may sound, there’s historical precedence (right after World War – III) for this scenario, and this is the most likely path for the Fed to solve the national debt crisis, as moving interest rates to 7-8% would cause a complete economic reset (most assets would lose ~70-90% of their value). The pandemic hit everyone, and most countries find themselves in similar or worse debt situations than the United States; hence, I am expecting global central banks to follow in US Fed’s footsteps to navigate this tricky economic environment.

Concluding Thoughts

With the understanding that higher inflation for longer and historically low-interest rates (10-yr remains in 3-4% range) is the base case scenario going forward, how and where should one invest?

Predicting macroeconomic events is a fool’s errand, and even if you are right, the market could do absolutely the opposite of what’s expected. Hence, we must control what we can control, i.e., buy great companies below their fair values and hold long-term. With deals galore in the high-growth stock universe (robust businesses trading at dirt-cheap valuations), I think this is an opportune moment for long-term investors seeking outperformance to invest aggressively in this space. Here at BTM, we invest in rapidly-growing, small-cap companies operating at the heart of secular-growth trends because these stocks could be big winners in the future regardless of economic factors.

My top ideas for 2022 have underperformed woefully in Q1; however, I view these price levels as generational buying opportunities. All five companies I picked – Upstart, Roku, Opendoor, Hims & Hers, and Shift – are disrupting massive industries and continue to win market share while growing revenues rapidly. Upstart and Roku are already free cash flow generative; Opendoor and Hims & Hers could get there by 2023, and Shift could get there by 2025. In order to beat inflation over long periods, we need to invest in businesses that could outgrow inflation and create exponential shareholder value over the long term (5-10 years).

Despite losing 40% in Q1, I am unflustered by the near-term price action. My investment horizon is 5+ years, and hence, I am doubling down on each of the five names we discussed here today. As soon as the market realizes the upper bound on interest rates, I think we will see a spectacular rebound in high-growth equities that, as of now, are coiled springs forming bases.

Historically, rate hike cycles have coincided with positive market returns, but we have never gone through a rate hike cycle with quantitative tightening of such scale (Fed selling $95B of bonds per month), and so we may continue to see heightened volatility. The war in Eastern Europe and mid-term elections in the US only add to the uncertainties. While we could certainly see more downside in my recommendations in the coming weeks and months, I expect a strong rebound in all of them by the end of this year, and my long-term return expectations from these ideas remain unchanged. At current price levels, I think of my top ideas as deep value stocks, and so I am doubling down on these stocks.

| BTM Fair Value |

2031 Price Target |

Ten-Year Expected CAGR return | |

|

Upstart (UPST) |

$679 | $2,924 | 41.45% |

| Roku (ROKU) | $475 | $3,031 | 38.74% |

| Opendoor (OPEN) | $38 | $256 | 42.76% |

| Hims & Hers (HIMS) | $29 | $235 | 47.63% |

| Shift (SFT) | $53 | $236 | 60.97% |

Key Takeaway: I rate Upstart, Roku, Opendoor, Hims & Hers, and Shift as strong buys at $91, $114, $7.3, $4.8, and $2, respectively.

Thanks for reading, and happy investing. Please share your thoughts, question, and/or concerns in the comments section below.